Cryptocurrency boom and dollar strengthening: a fintech expert explains how markets reacted to Trump's victory

Kyiv • UNN

After Trump's victory in the US presidential election, financial markets showed rapid growth. Bitcoin set a record of $75,000, Tesla shares rose by 12%, and the dollar strengthened its position.

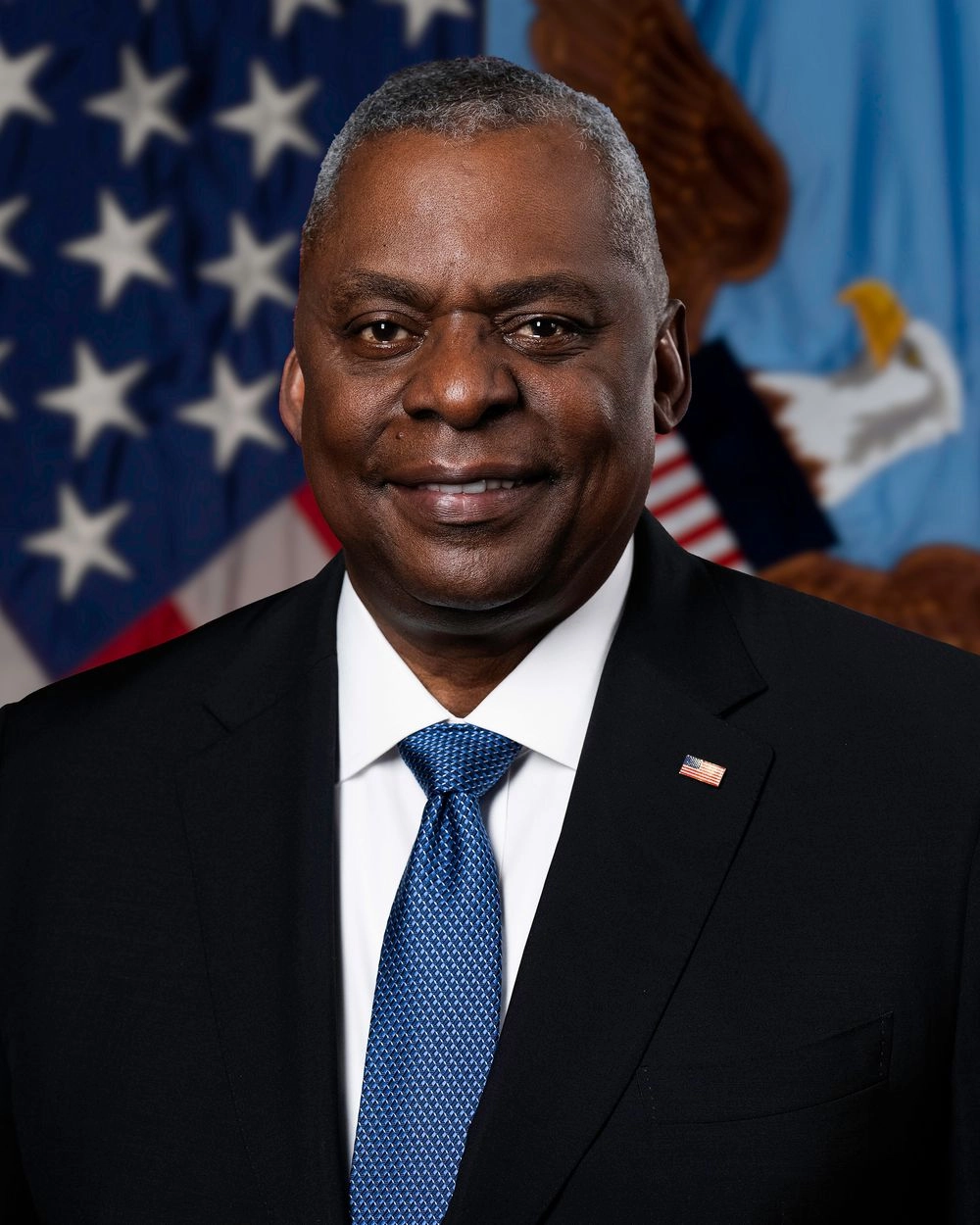

Following Donald Trump's victory in the 2024 U.S. presidential election, global financial markets responded with rapid growth, and the cryptocurrency sector has shown a significant rise. Olena Sosiedka , co-founder of Ukraine's first fintech ecosystem, Соnсоrd Fintech Solutions, shared her thoughts on this impact, including on cryptocurrencies, stock markets, and international currencies, with UNN.

Earlier, Olena Sosiedka told UNN that the "Defiant Ones" crypto platform announced by US presidential candidate Donald Trump could lead to a number of challenges in regulating the crypto sphere, as well as volatility in the market. At the same time, it may push other countries, including Ukraine, to adopt additional laws regulating the cryptocurrency market.

The expert also noted that statements by politicians of Trump's stature always have a significant impact on the markets. The cryptocurrency market is no exception. Therefore, Trump's announcement of the creation of a crypto platform can both strengthen confidence in cryptocurrencies and raise concerns. Political rhetoric can influence investor behavior and change the perception of cryptocurrencies in society, which in turn affects market trends.

After it became known that Trump had won the election, markets reacted immediately.

Positive signal for cryptocurrencies: record-breaking bitcoin

According to the fintech expert, the support of the crypto industry by the future American president has created optimism in the market, which has attracted both private and institutional investors. In particular, many large players started buying bitcoin, which caused its value to rise and pulled other cryptocurrencies, such as ethereum and litecoin, along with it.

"Thanks to Trump's positive attitude towards cryptocurrencies, the prices of bitcoin and other digital assets have risen sharply. Immediately after the election, bitcoin set a record, rising to $75,000, and ethereum and other altcoins also showed impressive growth. These changes can be explained by the fact that in his election campaign, Trump promised to turn the United States into a "bitcoin superpower" and ease regulatory barriers for cryptocurrencies," said Sosedka.

In addition, according to Elena Sosedka, the US cryptocurrency market will receive additional support in the future due to the composition of the new Congress. According to the CEO of Coinbase, one of the largest crypto exchanges, this composition is "the most pro-cryptocurrency in the history of the United States." The House of Representatives and the Senate now have 219 pro-cryptocurrency candidates, and their number will continue to grow.

"This creates new opportunities for creating a favorable regulatory environment," says Olena Sosedka.

In addition, she said, investors predict that changes in regulatory policy could create favorable conditions for cryptocurrencies. "Investors are also expecting a shift in the focus of cryptocurrency regulation from the SEC to the more loyal Commodity Futures Trading Commission (CFTC). This promise may lead to an inflow of new investments into the cryptocurrency market and further growth of its capitalization," the fintech expert summarized.

Reaction of fundsof the marketof the market: support from tech giants and Tesla's record

According to Olena Sosiedka, the US stock market experienced a sharp rise - stock markets gained $1.28 trillion over the day. The S&P 500 and Nasdaq indices rose by 2-3%, and special attention was drawn to Tesla shares, which added 12% to their value, increasing Elon Musk's wealth by $15 billion.

"This increase is directly related to Musk's support for Donald Trump and investors' expectations for future economic policy. The growth of Tesla shares has increased Musk's personal wealth by $15 billion, bringing his total fortune to $264 billion," the fintech expert explained.

Currency market reaction

After it became known that Donald Trump had won the presidential election, the US dollar strengthened against major world currencies in the currency markets. According to Olena Sosiedka, this is due to the growing confidence of investors in the stability of the US economy and the expected tax changes.

"This is due to investors' confidence in possible economic stability and the new administration's plans, which include tax cuts and support for tech companies," the fintech expert explained.

At the same time, she pointed out that the currencies of countries such as Iran have weakened. This is due to concerns about possible changes in US foreign policy.

"Donald Trump's victory has already led to significant changes in global financial markets. His support for the cryptocurrency sector has created additional demand for bitcoin and other digital assets, particularly from institutional investors. At the same time, Trump's victory strengthened the position of technology companies such as Tesla and led to a stronger dollar. The new administration is expected to promote the development of the crypto industry and reduce regulatory barriers, which creates positive expectations for financial markets in general," summarized Olena Sosiedka.