Tax authorities delay inspection of Concord Bank due to possible fraud

Kyiv • UNN

The tax audit of Concord Bank has been going on for over a year due to possible falsification of the results. The shareholders claim that the amount of the fine was illegally increased from UAH 700 thousand to UAH 392 million on the instructions of Danylo Getmantsev.

The tax audit of Concord Bank, which is in the process of liquidation, has been going on for more than a year and has not yet been completed. Such a delay raises serious questions about the transparency and objectivity of the actions of the tax authorities, UNN reports .

On August 1, 2023, the National Bank of Ukraine (NBU) decided to revoke the license of Concord Bank, after which the liquidation procedure was launched. According to the law, in such cases, a tax audit is mandatory, which usually lasts several months. However, in the case of Concorde, the audit lasted more than a year.

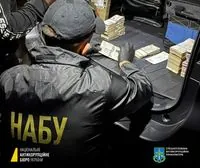

In fact, the first audit, as expected, lasted three months. Based on its results, the tax authorities drew up an act for UAH 700 thousand. However, according to Olena Sosiedka, co-owner of Concord Bank, the chairman of the Verkhovna Rada Committee on Finance, Taxation and Customs Policy, Danylo Hetmantsev, forced the amount of the fine in the act to be increased to almost UAH 400 million.

We know that based on its results (the results of the first tax audit - ed.), an act was drawn up in the amount of 700 thousand hryvnias, to which, on the personal instructions of the head of the Verkhovna Rada Tax Committee, Danylo Hetmantsev , 392 million hryvnias were illegally added, and why not a billion, 3 or 10 billion?

Thus, according to the bank's shareholders, the results of the first tax audit were falsified.The bank's liquidator, appointed by the Deposit Guarantee Fund, also disagreed with the audit report and filed its objections, after which an additional audit was ordered. This audit is still ongoing, which, according to experts, indicates a deliberate delay in the process by the tax authorities, as there are reasonable time limits for conducting an audit.

It is possible that the long delay in the audit in the case of Concorde may be due to the tax authorities' fears of being held liable for falsifying the audit results. After all, they can be held both administratively and criminally liable for violations.

If the court finds that the tax was unjustified, it may recover court costs, legal fees and non-pecuniary damage from the tax authority. The employees themselves may be subject to disciplinary action,

At the same time, lawyer Oleksandr Baidyk noted that the tax authorities could be held liable under the Criminal Code of Ukraine.

If there was a forgery of documents, it may be criminal liability, if it was just a mistake, it may be administrative liability. It all depends on the damage caused to the victim. If the tax authorities forged the whole thing (the audit report - ed.), it will definitely be criminal liability, if they miscalculated something, it will be administrative liability,

According to lawyers, the only way to force the tax authorities to complete the audit is to go to court. The court may order the tax authorities to complete the audit within a certain timeframe and ensure transparency and objectivity of the process. This will not only speed up the process of liquidating the bank, but will also be an important step in restoring confidence in the country's tax system.

There must be a rule of law procedure: there is a procedure provided for by law, you must follow it. If you don't follow this procedure, the interested parties whose rights or interests are violated must go to court. Unfortunately, the prosecutor's supervision over the observance of laws was abolished under Petro Oleksiyovych (Poroshenko - ed.), so today there is only one thing: the court. And unfortunately, the procedure there is such that you have to wait a long time for a court decision, because the courts are overcrowded today, and there are a lot of vacancies, so of course the judicial procedure for protecting rights in Ukraine is limited, unfortunately,

Recall

Despite the war in Ukraine, the process of removing banks from the market has not stopped. Thus, as of February 24, 2022, liquidation proceedings were initiated against 8 banks. In 2023, for the first time in Ukraine, not only bankrupt banks but also profitable institutions were subject to liquidation and license revocation, including Concord Bank. According to Olena Sosiedka, at the time the regulator announced the decision to liquidate the bank, the financial institution had enough highly liquid assets to make all the necessary payments in 2-3 weeks. However, the process of bank liquidation is strictly regulated by law and can generally take up to three years.

Add

Concorde's shareholders challenged in court the decision of the National Bank of Ukraine to withdraw the bank from the market. The Dnipropetrovs'k District Administrative Court declared unlawful and canceled the NBU's decision to revoke the license and liquidate Concord Bank. However, Ukrainian legislation is written in such a way that the process of removing a banking institution from the market, once started, is irreversible.