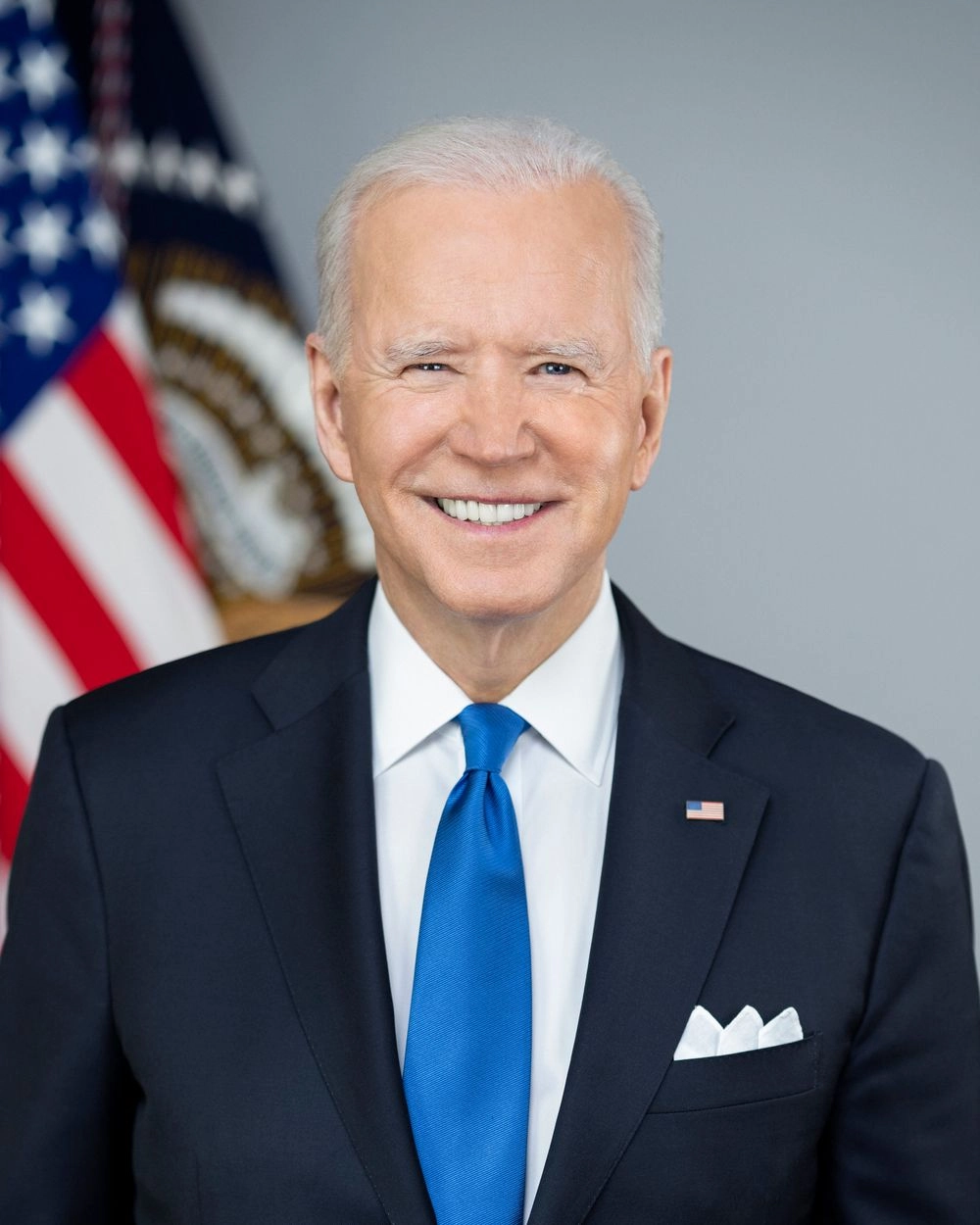

Goldman Sachs predicts stocks to rise and lists sectors that could benefit after the US election

Kyiv • UNN

Goldman Sachs predicts that the US stock market will grow by the end of 2024 after Trump's victory. The bank has identified key sectors for investment, including the chemical industry, automotive and defense sectors.

The article lists the stocks in which Goldman Sachs invests, taking into account the likely policies of Donald Trump as president.

Written by UNN with reference to Milano Finanza and Business Insider.

Details

Goldman Sachs predicts an active scenario for stocks by the end of 2024, as the S&P 500, Dow Jones and Nasdaq 100 indexes hit record highs after Donald Trump's victory, supported by expectations of pro-business policy.

Three key growth factors:

1) revision of political uncertainty. Goldman notes that during election years, S&P showed an average yield of 4% between Election Day and the end of the year. If this trend repeats, the index may gain 6,015 points.

2) reallocation of capital in favor of shares. It is expected that with the stabilization of the political situation, more funds will go to the S&P 500, which will help to improve its performance.

3) Increase in M&A (M&A) and IPO activity. Goldman Sachs predicts a M&A boom under the Trump administration. The relaxation of rules that previously restricted this activity will help to increase corporate spending and strengthen business confidence.

Stocks in which Goldman Sachs invests

The winners, according to the investment bank, are likely to be the companies that are most dependent on sales in the United States, stocks that are considered to be beneficiaries of reshoring (returning industrial production to the United States).

At the same time, risks will focus on the vulnerability of China's supply chains.

- Chemical sector.

The impact of higher duties is a concern for many, but the sector "should be relatively minor. Overall, the chemical sector will be weaker due to China's growth concerns.

- Automotive industry.

Sales centered on the United States, as in the case of Stellantis, "rely heavily on production in Mexico and Canada." The US currently applies a 2.5% duty on finished cars imported from Europe, while Europe applies a 10% duty on cars imported from the US.

If the US raises duties to 17.5%, it will affect Volvo's Ebit in the first place, followed by Mercedes, Porsche, BMW, and VW.

- Aerospace industry.

Goldman Sachs' analysis of previous trade disputes (e.g., WTO with Boeing) shows that Airbus has "a lot of room for mitigation.

- Defense

The most controversial sector. Analysts believe that the main purchases will take place later.

- Metals

Most likely, they will benefit from stimulating the Chinese economy. With the arrival of Trump as president, the duties will be increased, which were promised.

At this point, China is likely to finally launch a long-awaited large-scale stimulus for the economy, and it will be worth buying the most depressed stocks.

- Oil

Market interest in Shell is growing, "a high quality stock (a really great third quarter), a green card for US and especially European investors. "British Petroleum gets a tick for being just plain bad (BP gets a tick for being just plain bad.....)"; while TotalEnergies and Eni ‘are the companies where the market values leverage the most,’ writes Goldman Sachs, possibly referring to the large sales Eni recently made and past dividends tied to oil prices.

- Utilities

"The Biggest Losers. Markets are not expecting an IRA repeal or a tax credit repeal, but these two measures may be limited. Trump's victory in the presidential election will result in a loss of $1 billion in total spending in the energy sector, which is currently estimated at $7.7 trillion by 2050. WoodMac analysts expect that Trump's policies will pay less attention to sources and green technologies.